CASE STUDY

How an international bank reduced mortgage application processing time with Bragi

Discover how Bragi helped an international bank automate mortgage application process reporting, gain full pipeline visibility, and reduce a persistent backlog.

Trusted for regulated and high‑stakes data:

Turning a manual mortgage tracker into an automated reporting pipeline

The project focused on improving visibility, control, and reporting across the bank’s mortgage application process.

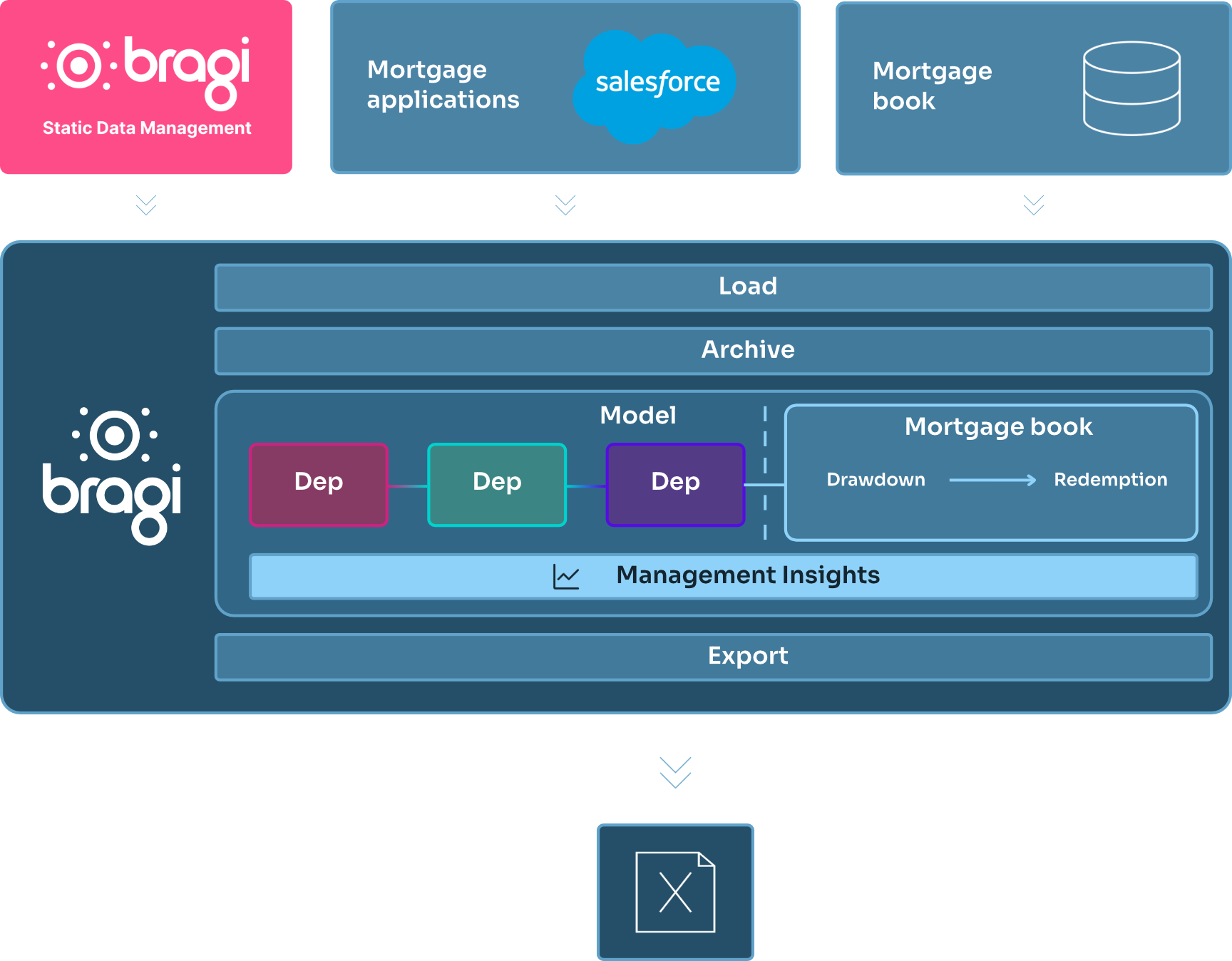

Using Salesforce as the CRM and Temenos T24 as the banking platform, the team implemented Bragi to bridge the gap to automate data extraction and replace manual spreadsheet tracking with an auditable end-to-end reporting pipeline.

The goal was to reduce operational risk and provide management with reliable, actionable insights in near real-time.

About the client

The client is an international bank processing a high volume of retail and commercial mortgage applications and using Salesforce as its CRM across a diverse book of business.**

The challenge

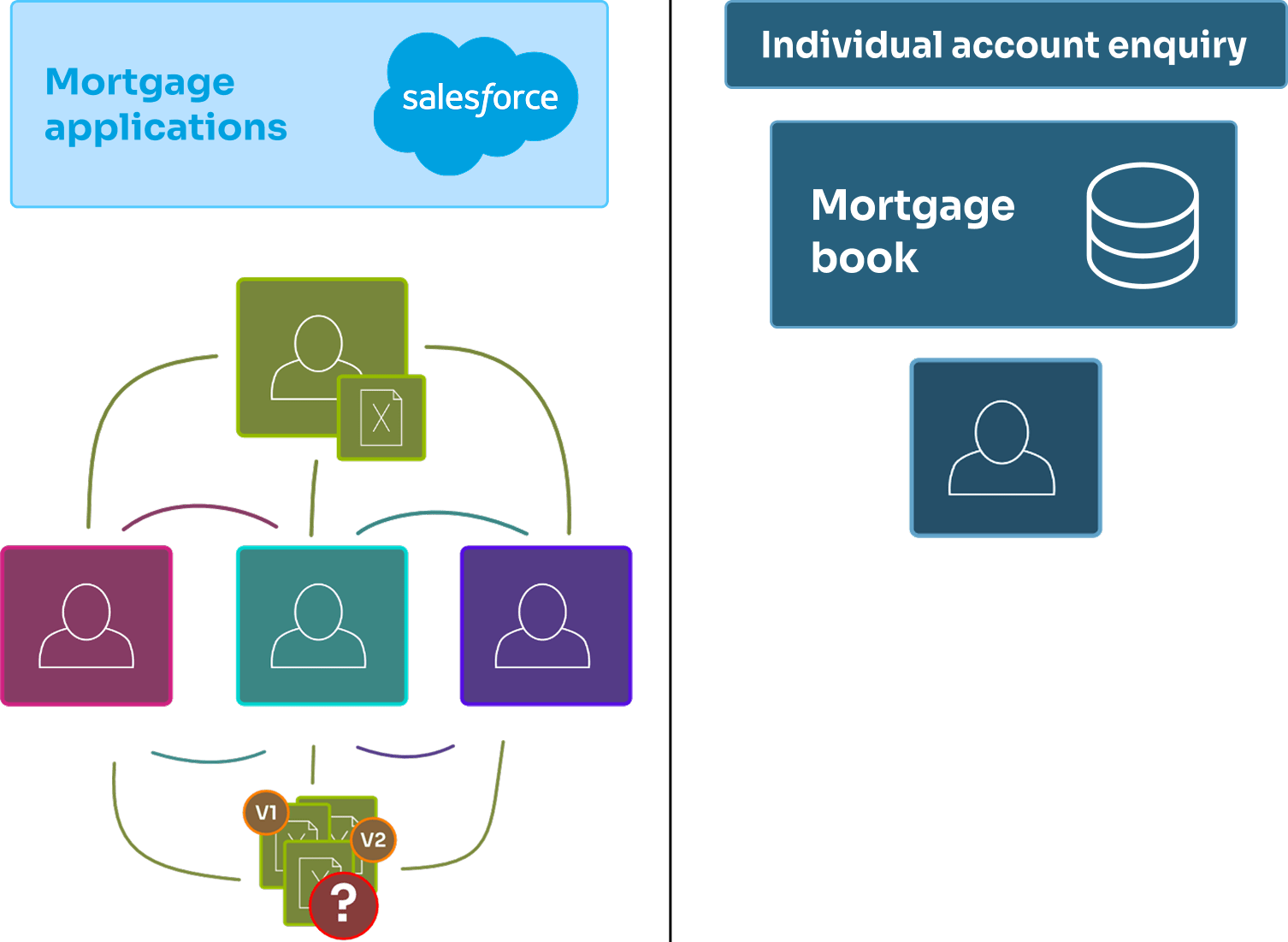

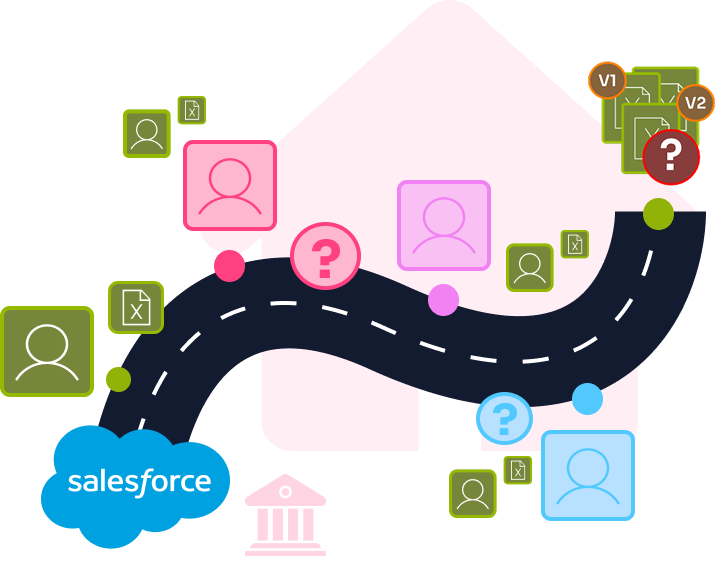

The bank needed to reconstruct the full mortgage journey and gain shared visibility over all in-progress applications. That meant:

- Overcoming system-level gaps in Salesforce (no easy-access history or department mapping)

- Eliminating manual spreadsheet tracking and its associated errors

- Identifying stalled or unsuitable cases early enough to improve customer experience

Without a reliable, end-to-end view of the process, the bank could neither analyse performance nor systematically improve it.

Where Bragi fit in

Bragi automated the data load from Salesforce and built a managed view of every mortgage application, giving the bank a single, trusted pipeline view without relying on spreadsheets.

Using Bragi’s modelling and Static Data Management capabilities, the team inferred key handoffs that Salesforce did not record, mapped users to departments, and generated a continuous end-to-end journey for each case.

Automated reports now give Sales, Onboarding, and Credit a single, shared view of all in‑flight applications, along with insight into redemption, loans entering arrears, early redemptions, and time to resolution – turning a static backlog into an actively managed pipeline.

Is this relevant to you?

This case study is especially useful if you:

- Run cross-department onboarding pipelines and struggling with visibility

- Rely on spreadsheets or manual exports to track application status

- Struggle to reconstruct end-to-end journeys across multiple systems

- Need fresher, more reliable pipeline reporting to reduce backlogs and improve customer experience

PDF DOWNLOAD

Get the in-depth breakdown

Read the complete case study to see how Bragi transformed mortgage application processing for this international bank, including the data model, Type 2 tracker archive, and reporting views behind the backlog reduction.

No personal data required, instantly view the in-depth case study. Download now